Understanding the Concept of a Housing Bubble

A housing bubble is a situation where house prices increase rapidly to levels that are unsustainable, often driven by speculation. It’s like a balloon that keeps inflating—everyone knows it can’t keep going forever, but predicting when it will pop is tricky. Historically, housing bubbles have been followed by sharp declines in prices, leading to financial turmoil. The 2008 financial crisis is a prime example, where the burst of the housing bubble had widespread economic repercussions. Experts often look for signs like rapid price increases and over-leveraged buyers to identify potential bubbles. Understanding these factors can help in assessing whether we’re currently in a similar situation.

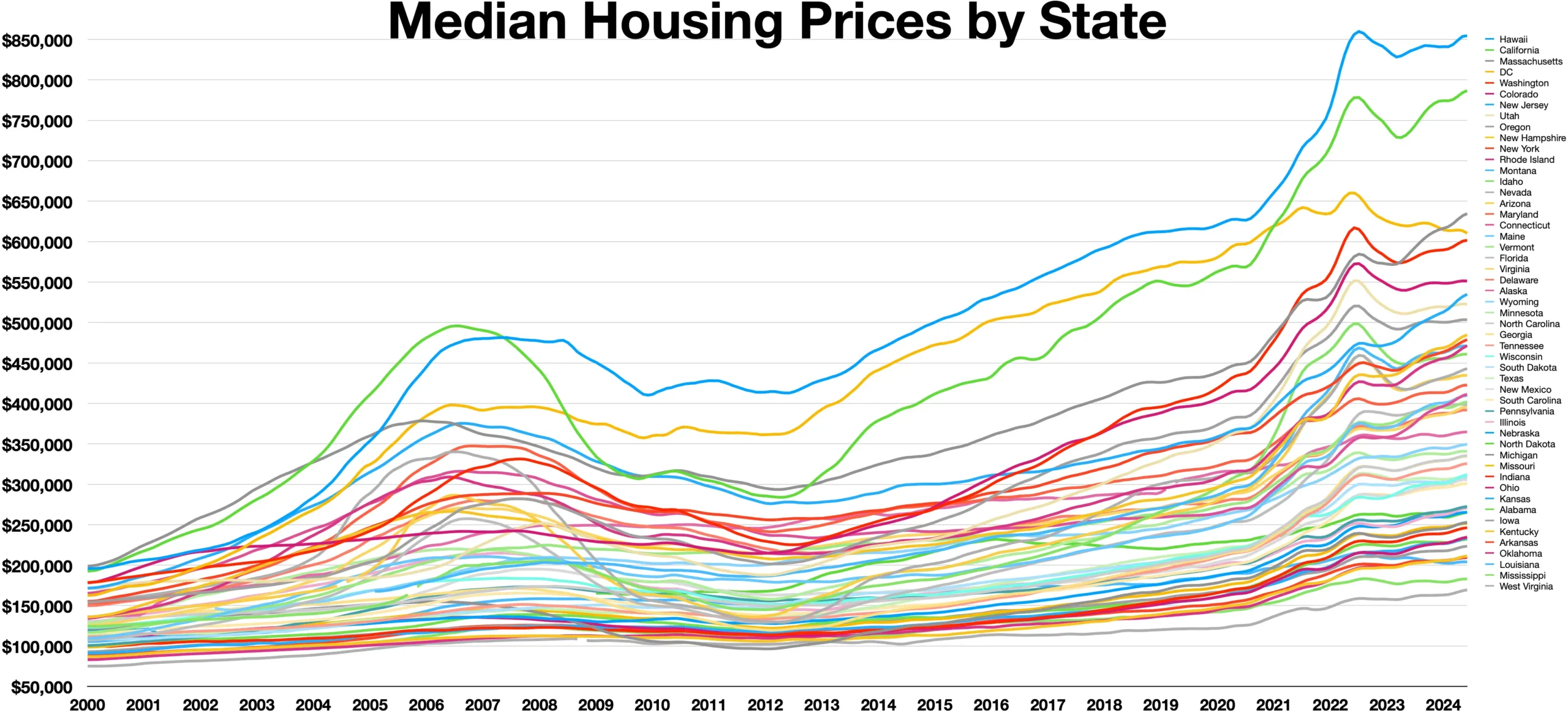

Current Trends in the Housing Market

In recent years, the housing market has seen significant changes, with prices climbing steadily. According to the National Association of Realtors, the median home price in the U.S. increased by 16% from 2020 to 2021. This surge is attributed to factors such as low mortgage rates, increased demand, and limited supply. However, some experts argue that these trends are not indicative of a bubble but rather a market correction. They point out that the demand is driven by genuine need rather than speculative buying. On the flip side, others worry that such rapid price increases might not be sustainable in the long run.

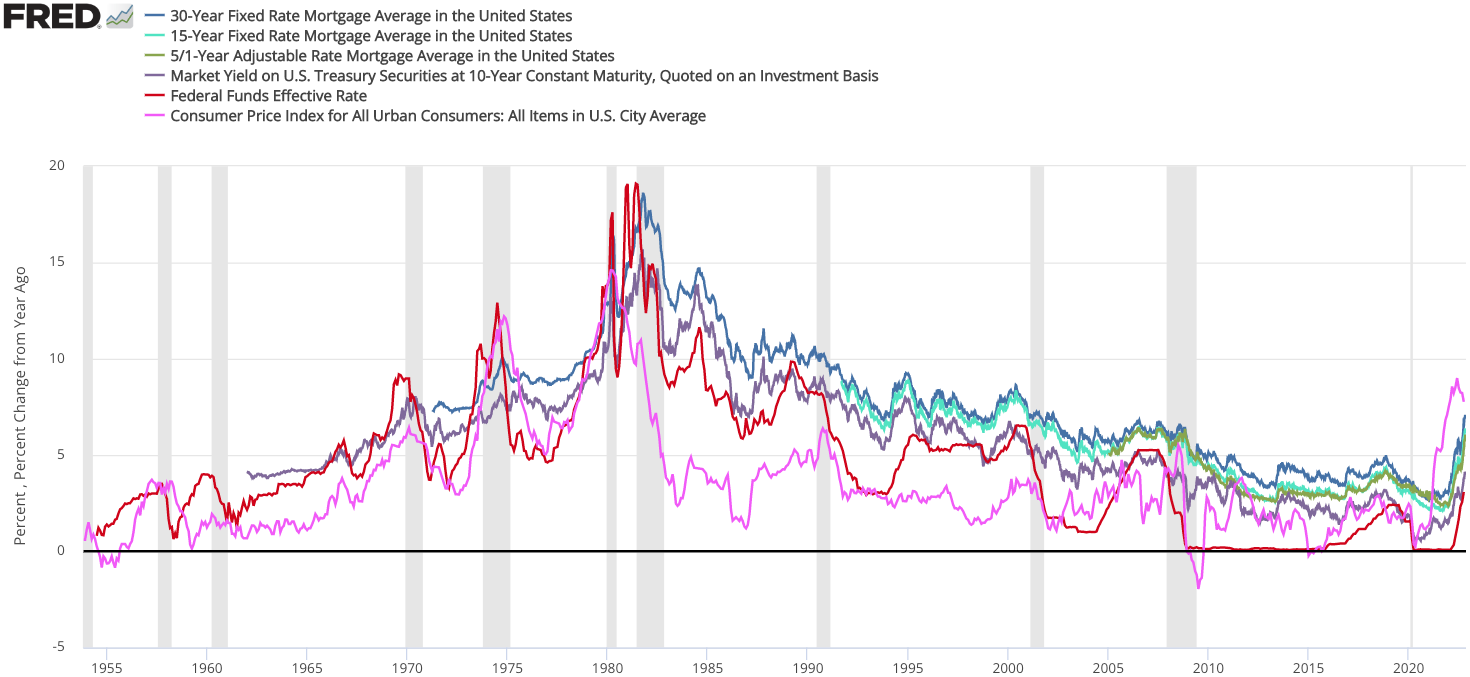

The Impact of Interest Rates

Interest rates play a crucial role in the housing market, influencing both buyers and sellers. Low interest rates make borrowing cheaper, encouraging more people to buy homes. This increased demand can drive up prices, contributing to a potential bubble. However, when interest rates rise, borrowing becomes more expensive, potentially cooling down the market. The Federal Reserve’s policies on interest rates are closely watched by experts as an indicator of future market trends. It’s a delicate balance—keeping rates too low for too long can inflate a bubble, while raising them too quickly can stifle growth.

Supply and Demand Dynamics

The basic economic principle of supply and demand is a significant factor in the housing market. Currently, there’s a notable shortage of housing inventory, with many areas experiencing more buyers than available homes. This imbalance contributes to rising prices as buyers compete for limited properties. Builders are struggling to keep up with demand due to factors such as labor shortages and rising material costs. Some experts argue that until the supply catches up with demand, prices will continue to rise. Others caution that if demand wanes or supply suddenly increases, prices could stabilize or even decline.

The Role of Government Policies

Government policies can greatly influence the housing market. Tax incentives, zoning laws, and housing subsidies are just a few ways governments can impact housing affordability and availability. For instance, during the COVID-19 pandemic, many governments introduced measures to support the housing market, such as mortgage relief and eviction moratoriums. These policies can provide temporary stability, but experts warn they might also create distortions in the market. As these measures are phased out, the true state of the housing market may become clearer, potentially revealing vulnerabilities.

Expert Opinions: Divergence in Views

Experts are divided on whether the current housing market is in a bubble. Some, like economist Robert Shiller, who predicted the 2008 crisis, suggest caution, citing unsustainable price growth. Others, like Lawrence Yun from the National Association of Realtors, believe the market is fundamentally strong, driven by real demand and low supply. This divergence in views highlights the complexity of the housing market and the difficulty in predicting its future. Buyers and investors must weigh these differing opinions and consider their own circumstances before making decisions.

Regional Variations: A Tale of Two Markets

The housing market is not uniform across the country; there are significant regional variations. Some areas, like San Francisco and New York, have seen dramatic price increases, leading to concerns about bubbles in these specific markets. Other regions, particularly in the Midwest, have experienced more moderate growth, suggesting a healthier balance between supply and demand. Experts emphasize the importance of looking at local market conditions rather than relying solely on national trends. Understanding these regional dynamics can provide a clearer picture of the overall market health.

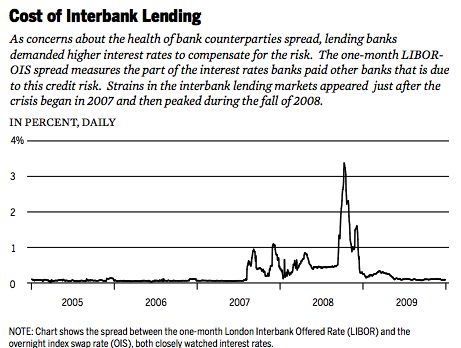

Lessons from the Past: The 2008 Financial Crisis

The 2008 financial crisis serves as a stark reminder of the potential dangers of a housing bubble. Leading up to the crisis, easy credit, speculative buying, and risky lending practices led to an unsustainable market. When the bubble burst, it triggered a global economic downturn. Many experts stress the importance of learning from past mistakes to avoid a similar situation. While there are some parallels between then and now, such as rising prices, there are also significant differences, including stricter lending standards and more cautious buyers.

Technological Disruptions: The New Age of Real Estate

Technology is playing an increasingly important role in the housing market. Online platforms like Zillow and Redfin have made it easier for buyers to compare prices and find homes, increasing market transparency. Virtual tours and digital transactions have also become more common, especially during the pandemic. While these advancements have made home buying more accessible, they also introduce new dynamics into the market. Experts are watching how these technological changes might impact housing prices and buyer behavior in the long run.

Looking Ahead: What the Future Holds

Predicting the future of the housing market is challenging, with many variables at play. Experts are closely monitoring factors like interest rates, government policies, and economic conditions. While some believe the market will continue to grow, others caution that we might be nearing a peak. Buyers and investors should stay informed and consider a range of scenarios before making decisions. As the market evolves, being adaptable and prepared for changes will be key to navigating the complexities of the housing market.