The Hidden Cost of Savings Accounts

Many people believe that savings accounts are a safe place to store money, but often overlook the hidden costs associated with them. While it’s true that these accounts offer security, the interest rates are typically so low that they barely keep up with inflation. Inflation is the gradual increase in prices over time, and if your savings account doesn’t outpace it, you’re essentially losing purchasing power. For example, if inflation is at 3% and your savings account offers 1% interest, your money is losing value every year. It’s like trying to fill a leaking bucket; you keep adding more, but the water level never rises. Over time, this can lead to significant financial loss.

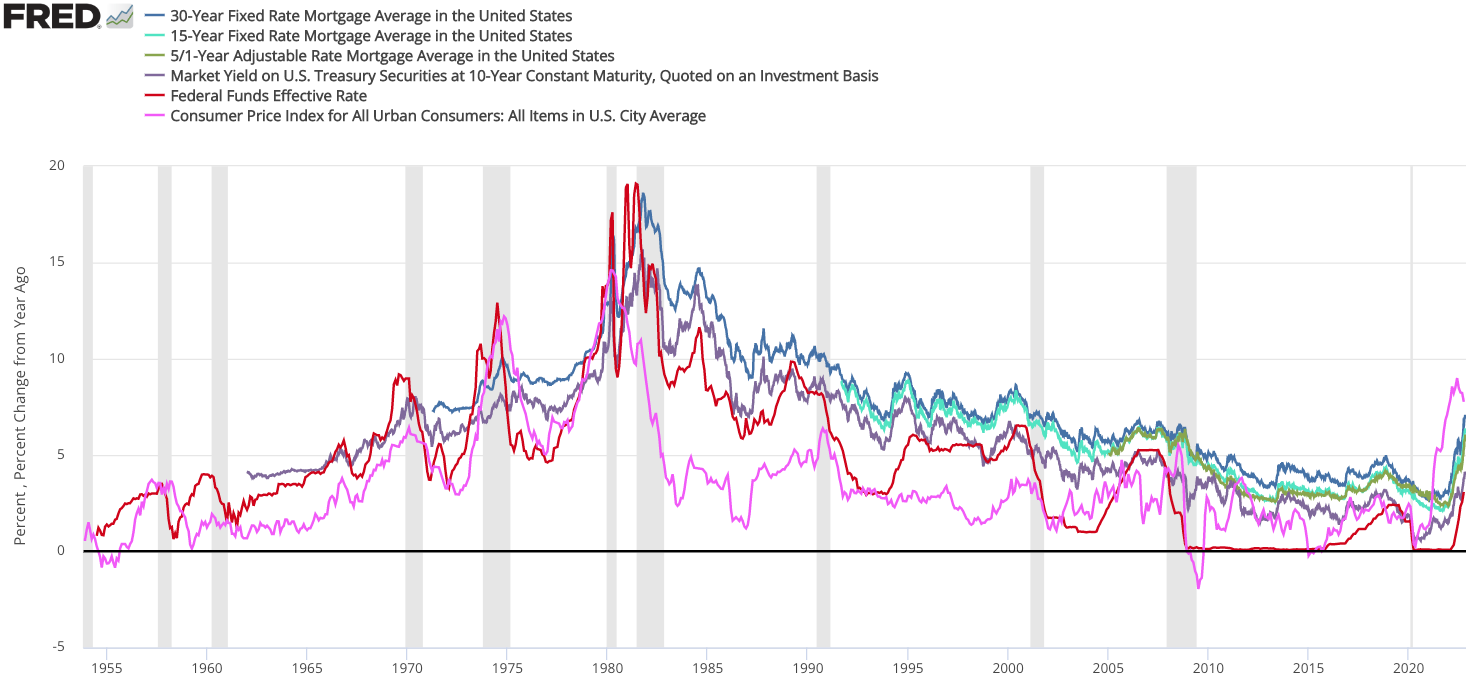

Understanding Inflation and Its Impact

Inflation is a silent thief that gradually erodes the value of your money. Imagine that a loaf of bread costs $2 today. With 3% inflation, that same loaf might cost $2.06 next year. If your savings only grow by 1% annually, you’ll find your dollar buys less than it did before. This is why it’s crucial to understand how inflation impacts savings. Many people are unaware of the inflation rate in their country and how it compares to their savings interest rate. This lack of awareness can lead to financial stagnation, where your money doesn’t grow as it should.

Low Interest Rates: A Double-Edged Sword

The low interest rates offered by savings accounts are a double-edged sword. On one hand, they provide a sense of security with guaranteed returns. On the other, they limit the growth potential of your savings. These rates are often set by central banks to encourage spending and investment, but they can be detrimental to those who rely solely on savings accounts for financial growth. It’s like planting a tree in poor soil; it may grow, but it will never reach its full potential. Understanding this can be the first step in seeking better financial opportunities.

Why People Stick with Savings Accounts

Despite the drawbacks, many people stick with savings accounts due to their simplicity and perceived safety. They offer easy access to funds in case of emergencies, which is a significant advantage. However, this convenience comes at a cost. The fear of losing money in riskier investments often keeps individuals from exploring other options. It’s like choosing a well-trodden path in a forest because it feels safer, even though it may not lead to the best destination. Understanding the reasons behind this choice can help individuals make more informed financial decisions.

Exploring Alternative Investment Options

To counteract the effects of inflation and low interest rates, exploring alternative investment options is essential. Stocks, bonds, and mutual funds are popular choices that offer higher returns than traditional savings accounts. Although these options come with risks, they also provide opportunities for growth. Investing in stocks is like riding a roller coaster – there are ups and downs, but the thrill and potential rewards are substantial. Diversifying your portfolio by investing in a mix of assets can help balance risk and reward, allowing your money to grow more effectively.

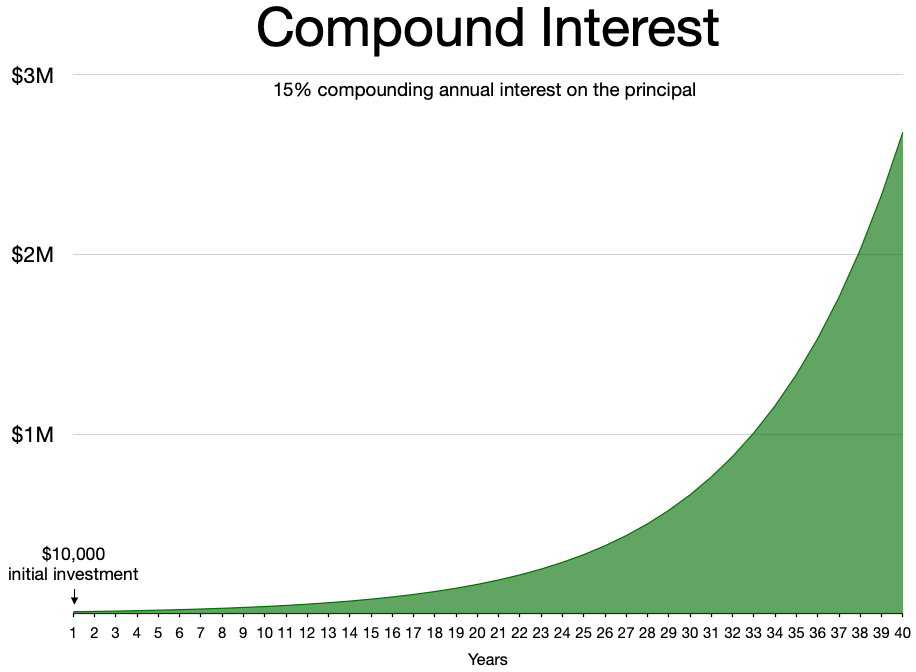

The Power of Compound Interest

Compound interest is a powerful tool that can significantly enhance your savings. Unlike simple interest, which is calculated only on the principal amount, compound interest is calculated on both the principal and the accumulated interest. It’s like a snowball rolling down a hill, gathering more snow and growing larger as it goes. By reinvesting earnings, compound interest allows your investments to grow exponentially over time. This is a key concept to understand when seeking alternatives to savings accounts, as it can dramatically increase your financial growth.

Understanding Risk and Reward

Investing always involves a balance between risk and reward. Higher returns typically come with higher risks, and it’s essential to understand your risk tolerance before making investment decisions. Some individuals are comfortable with high-risk investments, while others prefer more conservative options. It’s like choosing between a thrilling roller coaster ride and a gentle carousel – both have their merits, but your preference depends on your comfort level. Understanding this balance can help you make informed decisions about where to allocate your money for the best returns.

The Role of Financial Advisors

Financial advisors play a crucial role in helping individuals navigate the complexities of investing. They can provide valuable insights into market trends and recommend strategies tailored to your financial goals. Just like a tour guide leading you through unfamiliar terrain, a financial advisor can help you avoid pitfalls and make informed decisions. They offer expertise and experience that can be invaluable, especially for those new to investing. Seeking professional advice can be a wise step in maximizing your financial potential and achieving long-term growth.

Building a Diversified Portfolio

A diversified portfolio is essential for minimizing risk and maximizing returns. By spreading investments across various asset classes, you can protect yourself from significant losses if one sector performs poorly. It’s like not putting all your eggs in one basket; if one basket drops, you still have others left. Diversification can include stocks, bonds, real estate, and more, providing a balanced approach to investing. This strategy can help ensure your financial stability and growth, even in uncertain economic times.

Reevaluating Your Financial Strategy

Reevaluating your financial strategy is crucial in today’s ever-changing economic landscape. Sticking with a savings account may seem safe, but it’s important to consider whether it truly aligns with your long-term financial goals. By exploring alternative investment options and seeking professional advice, you can develop a strategy that better suits your needs. It’s like charting a new course on a map, ensuring you reach your desired destination. Taking proactive steps to improve your financial strategy can lead to greater financial security and peace of mind.