Understanding Inflation: A Simple Explanation

Inflation is a term that’s often thrown around in financial circles, but what does it really mean for the average person? At its core, inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. Imagine you have $100 today; if inflation is at 2%, next year you might need $102 to buy the same things. This is why inflation is sometimes called the “silent thief”—it slowly takes away your buying power without you even noticing. It’s crucial to understand this because it directly impacts your savings and investments. If your investments don’t grow at a rate higher than inflation, you’re essentially losing money over time.

The Direct Impact on Your Investments

When inflation rises, the value of money decreases, which means that the real return on your investments can be lower than expected. For example, if your investment portfolio grows by 5% in a year, but inflation is 3%, your real return is only 2%. This can be particularly challenging for fixed-income investments like bonds, which offer steady but often lower returns. Investors should be aware that inflation can eat into their returns, making it essential to seek investment opportunities that can outpace inflation. Stocks, real estate, and commodities are often considered inflation hedges since they have the potential to offer returns that exceed the inflation rate.

Inflation and Stock Market Performance

Stocks are generally considered a good hedge against inflation because companies can increase their prices to offset rising costs. However, this doesn’t mean stocks are immune to the effects of inflation. High inflation can lead to higher interest rates, which can negatively impact stock prices. Companies with significant debt may struggle as their borrowing costs rise, potentially affecting their profitability. Investors should focus on companies with strong pricing power and low debt levels. Diversifying your stock portfolio can also help mitigate some of the risks associated with inflation.

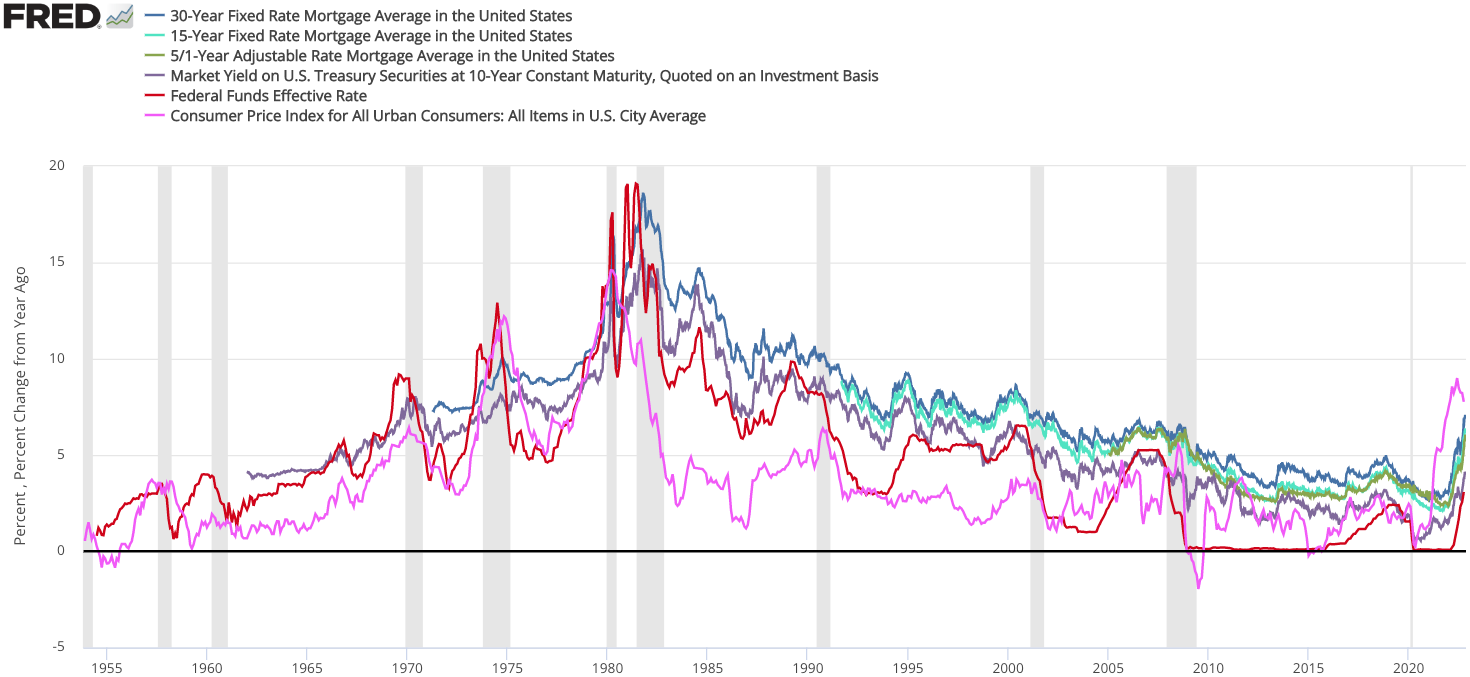

The Role of Interest Rates

Interest rates and inflation are closely linked. Central banks, like the Federal Reserve in the United States, often raise interest rates to control high inflation. When interest rates go up, borrowing becomes more expensive, which can slow down economic growth and affect investment returns. Higher interest rates can also lead to lower bond prices, impacting fixed-income investors. It’s essential to understand this relationship because it can help you make informed investment decisions. Keeping an eye on interest rate trends can provide valuable insights into potential market movements.

Real Estate as an Inflation Hedge

Real estate is often touted as a good hedge against inflation. Property values tend to rise over time, and rental income can increase with inflation, making real estate an attractive investment option. However, it’s important to consider the costs associated with real estate, such as maintenance, property taxes, and mortgage interest rates. These factors can impact your overall return on investment. Investing in real estate investment trusts (REITs) can offer exposure to real estate without the hassle of property management. REITs provide a way to diversify your portfolio and potentially benefit from rising property values.

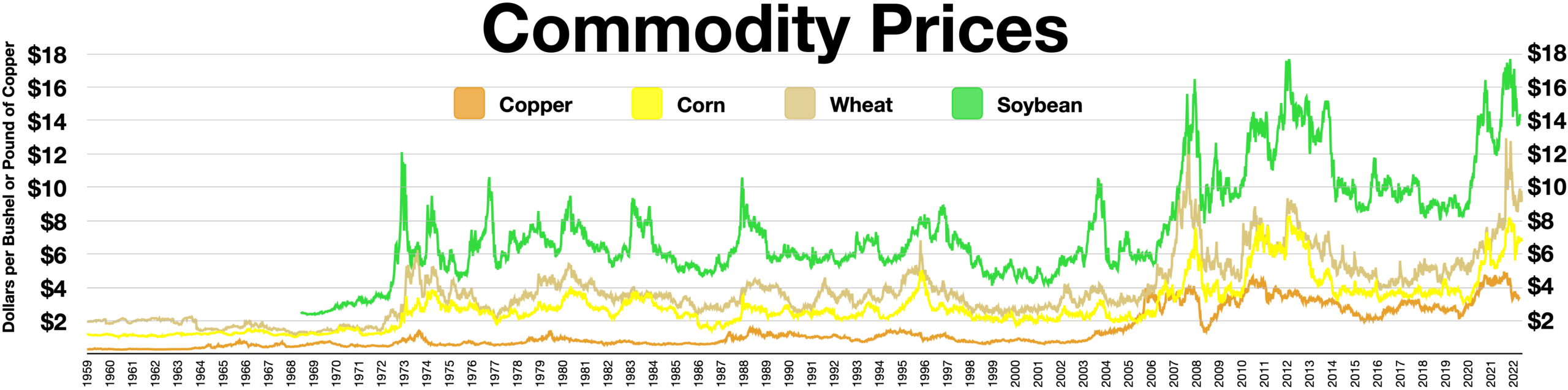

Commodities: A Natural Inflation Buffer

Commodities like gold, oil, and agricultural products have historically been seen as a hedge against inflation. When inflation rises, the prices of these goods often increase as well. Investing in commodities can provide a buffer against inflationary pressures, but it’s important to note that commodity prices can be volatile. Factors such as geopolitical tensions, supply chain disruptions, and changes in demand can impact commodity prices. Investors should consider their risk tolerance and investment goals when adding commodities to their portfolios. Diversifying across different commodities can help manage volatility.

Adjusting Your Investment Strategy

To combat the effects of inflation, it’s crucial to regularly review and adjust your investment strategy. Diversification is key; spreading your investments across different asset classes can help reduce risk. Consider incorporating assets that traditionally perform well during inflationary periods, such as stocks, real estate, and commodities. Additionally, maintaining a long-term perspective can help you weather short-term market fluctuations. Staying informed about economic trends and central bank policies can provide valuable insights for making strategic adjustments to your portfolio.

The Importance of Financial Planning

Inflation can have a significant impact on your long-term financial goals, such as retirement planning. It’s essential to factor inflation into your financial planning to ensure you can maintain your desired lifestyle in the future. Consulting with a financial advisor can help you develop a comprehensive plan that accounts for inflationary pressures. They can assist in selecting appropriate investment vehicles and creating a diversified portfolio that aligns with your risk tolerance and financial objectives. Regularly reviewing and updating your financial plan can help you stay on track to achieve your goals.

Staying Informed and Educated

In an ever-changing economic landscape, staying informed about inflation trends and their impact on investments is crucial. Reading financial news, attending seminars, and following market analyses can help you stay updated on the latest developments. Understanding the factors driving inflation and how they affect different asset classes can empower you to make informed investment decisions. Education is a powerful tool for navigating the complexities of inflation and safeguarding your financial future. Taking the time to learn about inflation and its implications can provide you with a competitive edge in the investment world.

Conclusion: Taking Action Against Inflation

While inflation is an inevitable part of economic cycles, understanding its impact on your investments can help you take proactive steps to protect and grow your wealth. By diversifying your portfolio, staying informed, and adjusting your investment strategy, you can mitigate the effects of inflation and work towards achieving your financial goals. Remember that inflation is not just a financial concept—it’s a real force that affects your everyday life. Taking action today can help secure a more financially stable future, allowing you to navigate the challenges of inflation with confidence.