Dividend Growth Investing: The Silent Wealth Builder

Dividend growth investing might not be the flashiest strategy, but it has proven to be a steady and reliable wealth builder. By focusing on companies that regularly increase their dividend payouts, investors can benefit from a growing stream of income over time. This strategy often involves investing in well-established companies with a track record of financial stability. Think of it as planting a tree that bears more fruit every year. Many investors overlook this strategy because it doesn’t promise quick riches, but history shows that it can lead to substantial wealth accumulation. A study by Ned Davis Research found that dividend growers have outperformed non-dividend payers by a significant margin over the past few decades.

Value Investing: Finding Diamonds in the Rough

Value investing is all about finding stocks that are undervalued by the market. It’s like shopping for clothes at a thrift store and finding a designer brand at a fraction of the price. This strategy was popularized by legendary investors like Warren Buffett, who famously said, “Price is what you pay; value is what you get.” The goal is to buy these stocks at a discount and hold onto them until their true value is recognized by the market. Despite its proven track record, many investors shy away from value investing because it requires patience and a keen eye for spotting potential. However, those who master this strategy can achieve impressive returns.

Index Fund Investing: The Lazy Man’s Road to Riches

Index fund investing might sound too simple to be effective, but it’s one of the most powerful strategies available. By investing in a broad market index like the S&P 500, investors can gain exposure to a diverse array of companies without the need to pick individual stocks. This approach minimizes risk and often results in returns that outperform the majority of actively managed funds. It’s like riding an escalator instead of climbing stairs – you reach the same destination with less effort. According to Vanguard, index funds have consistently outpaced the average mutual fund over the long term. This strategy is perfect for those who prefer a hands-off approach to investing.

Real Estate Crowdfunding: New Age Property Investment

Real estate crowdfunding is a relatively new investment strategy that allows individuals to invest in real estate projects online. It democratizes property investment, making it accessible to those who may not have the capital to buy properties outright. It’s akin to pooling resources with friends to buy a shared vacation home. This strategy offers the potential for significant returns, as well as the benefit of diversification. While real estate crowdfunding is gaining popularity, many investors are still unaware of its potential. Platforms like Fundrise and RealtyMogul have made it easier than ever to get started in this space.

Peer-to-Peer Lending: Bank Like a Banker

Peer-to-peer (P2P) lending allows investors to lend money directly to individuals or small businesses, bypassing traditional financial institutions. This strategy can offer higher returns compared to traditional savings accounts or bonds. It’s like being the bank and earning interest on loans without the overhead. While P2P lending carries some risk, platforms like LendingClub and Prosper have systems in place to assess borrower creditworthiness. Investors can diversify their loans to mitigate risk and potentially earn a steady stream of income.

Options Trading: The Strategic Speculator

Options trading is often misunderstood and perceived as risky, but it can be a powerful tool for generating wealth when used correctly. By buying options, investors can speculate on the future price of a stock without actually owning it. It’s similar to placing a bet on a horse race – the payoff can be substantial if the bet is correct. Options can also be used to hedge existing positions, providing a safety net against market volatility. While options trading requires a certain level of expertise, platforms like Robinhood have made it more accessible to the average investor.

Tax Lien Investing: Profiting from Unpaid Taxes

Tax lien investing involves purchasing liens on properties with unpaid taxes. When property owners fail to pay their taxes, local governments can sell the liens to investors. It’s like acquiring a ticket to earn interest on someone else’s debt. If the property owner pays their taxes, the investor earns interest; if not, the investor may eventually acquire the property. This strategy can yield impressive returns, but it requires thorough research and due diligence. Despite its potential, many investors are unaware of tax lien investing or are hesitant to navigate the complexities involved.

Closed-End Funds: The Overlooked Opportunity

Closed-end funds (CEFs) are investment funds that trade on stock exchanges like individual stocks. Unlike mutual funds, CEFs have a fixed number of shares, which can lead to discounts when the market undervalues them. It’s like buying a product on sale because of excess inventory. These discounts can provide opportunities for savvy investors to buy high-quality assets at a bargain. CEFs often offer higher yields than traditional open-end funds, making them an attractive option for income-seeking investors. Despite their potential, CEFs remain relatively underutilized in the investment community.

Cryptocurrency Staking: Earning Passive Income in the Digital Age

Cryptocurrency staking involves holding digital assets in a wallet to support the operations of a blockchain network. In return, investors earn rewards in the form of additional cryptocurrency. It’s akin to earning interest on a savings account, but in the digital realm. Staking can provide a consistent stream of passive income, and as the popularity of cryptocurrencies continues to grow, so too does the potential for profits. Platforms like Binance and Coinbase offer staking services, making it easier for investors to participate. Despite its potential, staking remains an underrated strategy among traditional investors.

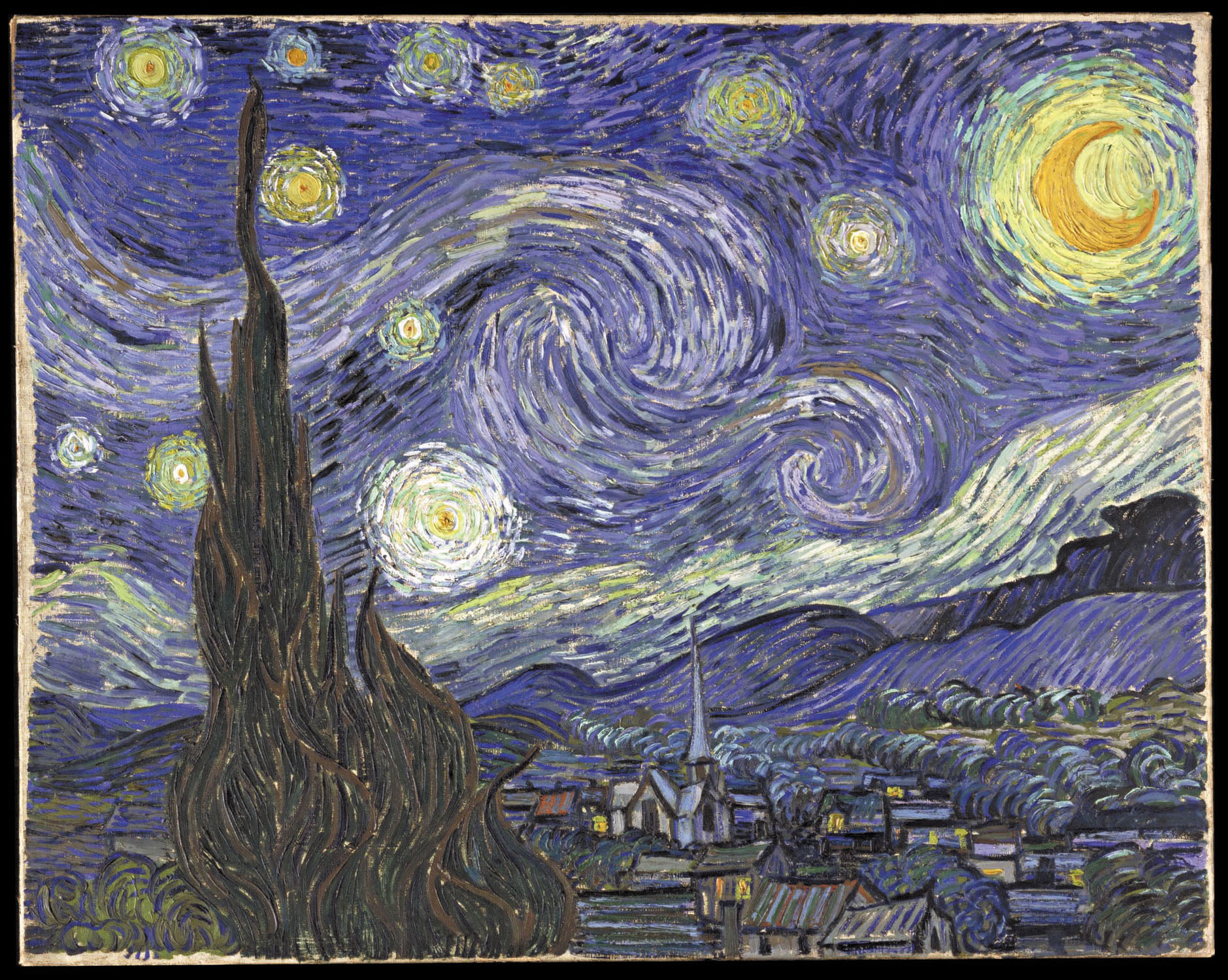

Investing in Art: Aesthetic Appreciation with Financial Flair

Investing in art may not be the first strategy that comes to mind, but it can be a lucrative and fulfilling endeavor. Art investments offer a unique combination of aesthetic enjoyment and financial potential. It’s like owning a piece of history that appreciates in value over time. The global art market has seen significant growth, and platforms like Masterworks allow individuals to invest in shares of high-value artwork. While art investing requires a certain level of expertise and patience, it can diversify an investment portfolio and provide substantial returns.