The Illusion of Control

Our brains are wired to crave control, especially when it comes to our finances. This illusion of control can lead investors to believe they have more influence over market outcomes than they actually do. Imagine feeling like a seasoned captain steering a ship through a storm, only to realize you’re on autopilot. Investors often overestimate their ability to predict stock movements, leading them to make hasty decisions. This overconfidence can result in frequent trading, increasing transaction costs and eroding potential profits. Research shows that individuals who trade frequently tend to earn lower returns than those who adopt a more passive approach. The belief that one can outsmart the market is a common cognitive bias, but in reality, the market can be unpredictable and unforgiving.

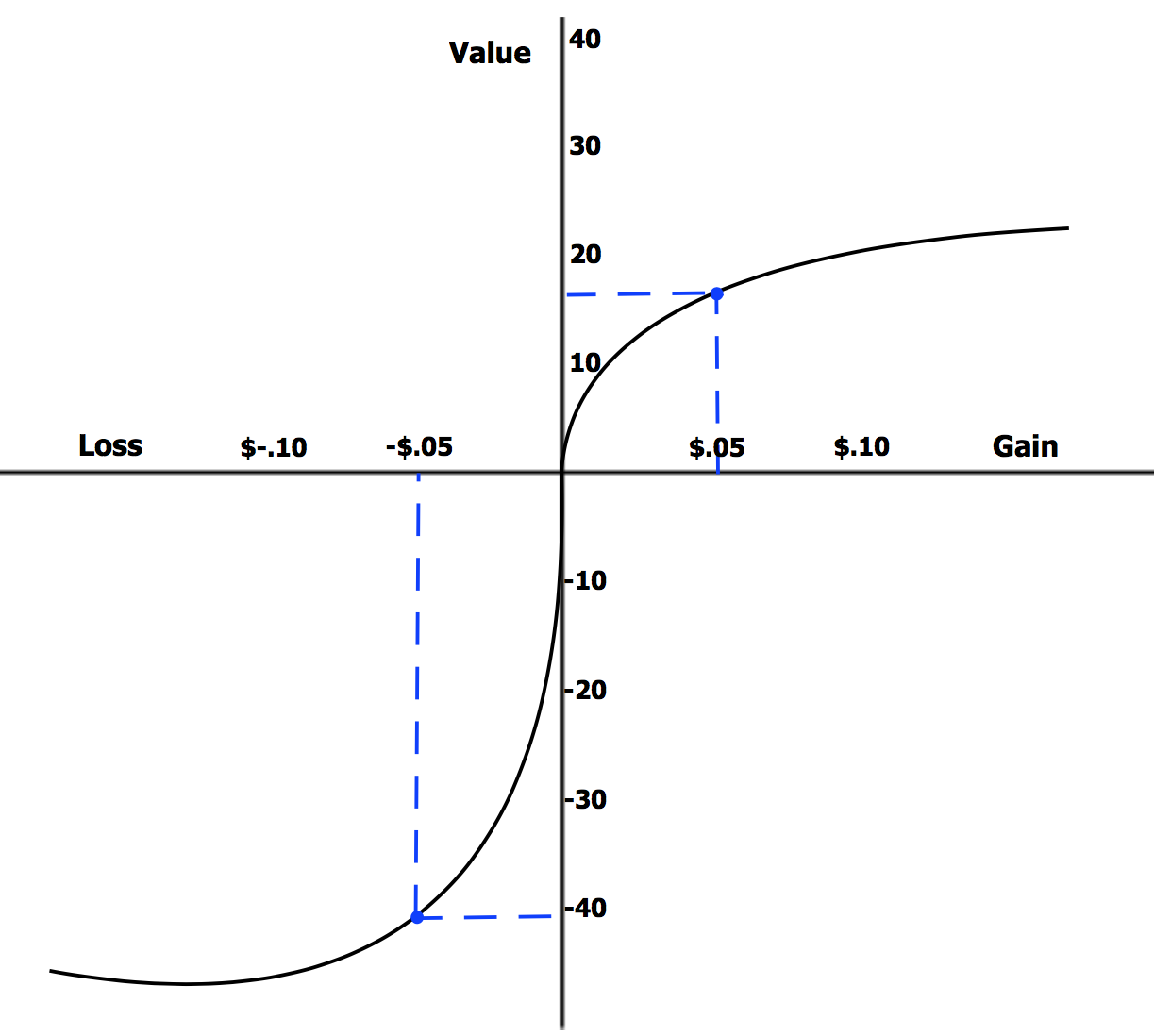

Loss Aversion and Its Impact

Loss aversion is a psychological phenomenon where the pain of losing is felt more acutely than the joy of gaining. This means that losing $100 feels worse than the happiness gained from earning $100. Investors, driven by this bias, may hold onto losing stocks longer than they should, hoping to recoup their losses. It’s like clinging to a sinking ship, hoping it will magically rise above water. This emotional attachment to losses can prevent investors from making rational decisions, leading to missed opportunities elsewhere. Studies have shown that this bias can cause investors to sell winning stocks too early to “lock in gains,” further impacting overall portfolio performance. Understanding this tendency can help investors make more informed decisions, focusing on long-term goals rather than short-term emotional reactions.

Overconfidence: The Silent Portfolio Killer

Overconfidence is another psychological trap that can lead to poor investment decisions. Many investors believe they are better than average, which leads them to take unnecessary risks. It’s like believing you’re an expert chef after cooking one successful meal. This overconfidence can result in underestimating risks and overestimating one’s ability to time the market. As a result, investors may make impulsive decisions, such as investing heavily in a single stock or sector. Research indicates that overconfident investors tend to trade more frequently, which can reduce overall returns due to increased transaction costs. Recognizing this bias can help investors adopt a more balanced and diversified approach, reducing the impact of overconfidence on their investment strategies.

The Herd Mentality

Humans are social creatures, and the desire to fit in can influence investment decisions. The herd mentality leads investors to follow the crowd, often resulting in buying high and selling low. Picture a stampede of animals rushing in the same direction without knowing why. This behavior is driven by the fear of missing out (FOMO) or the belief that the crowd must be right. However, following the herd can lead to inflated asset prices and bubbles, as seen in events like the dot-com bubble. Studies have shown that herd behavior can lead to market inefficiencies and increased volatility. By recognizing this tendency, investors can focus on their individual goals and strategies, avoiding the pitfalls of following the crowd blindly.

Anchoring: Stuck in the Past

Anchoring is a cognitive bias where individuals rely too heavily on the first piece of information they receive, known as the “anchor.” In investing, this can mean clinging to the initial purchase price of a stock, affecting future decisions. Imagine being stuck in a time loop, unable to move forward. Investors may refuse to sell a stock below its purchase price, even if market conditions have changed. This reluctance can prevent them from reallocating resources to more promising opportunities. Research has shown that anchoring can lead to suboptimal investment choices, as investors focus on past prices rather than current market realities. By being aware of this bias, investors can make more rational decisions based on current data and future potential.

Recency Bias: The Latest is Not Always the Greatest

Recency bias is the tendency to give more weight to recent events while ignoring historical data. Investors may be swayed by recent market trends, believing they will continue indefinitely. It’s like judging the weather based solely on yesterday’s forecast. This bias can lead to overreaction, causing investors to chase trends or panic during market downturns. Studies suggest that recency bias can lead to poor investment decisions, as investors base their actions on short-term fluctuations rather than long-term fundamentals. By recognizing this bias, investors can focus on building a diversified and resilient portfolio, taking into account both historical data and future projections.

The Confirmation Bias Trap

Confirmation bias is the tendency to seek out information that supports one’s existing beliefs while ignoring contradictory evidence. In investing, this can lead to reinforcing incorrect assumptions and making poor decisions. It’s like wearing blinders, only seeing what you want to see. Investors may selectively focus on positive news about their investments, dismissing warning signs. This bias can lead to overconfidence, excessive risk-taking, and ultimately, significant financial losses. Research indicates that confirmation bias can hinder learning and adaptability, as investors become entrenched in their views. By being open to diverse perspectives and challenging assumptions, investors can make more informed and balanced decisions.

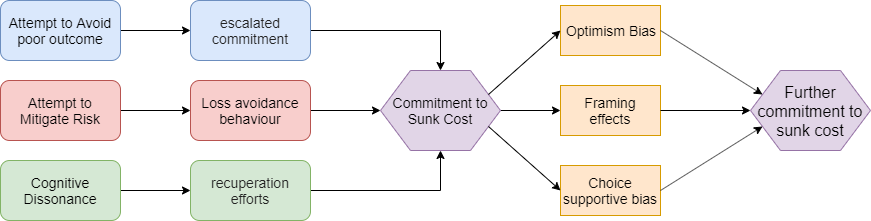

The Sunk Cost Fallacy

The sunk cost fallacy occurs when individuals continue investing in a losing proposition due to the resources already committed. It’s like continuing to water a dead plant, hoping it will bloom. Investors may hold onto losing stocks, believing they must recover their initial investment. This fallacy can lead to poor decision-making, as past costs should not influence future actions. Studies have shown that the sunk cost fallacy can result in increased financial losses, as investors fail to cut their losses and move on. By acknowledging this bias, investors can make more rational decisions, focusing on potential future returns rather than past expenditures.

Emotional Investing: The Heart vs. The Head

Emotions play a significant role in investment decisions, often leading to impulsive actions. Fear and greed are powerful motivators, driving investors to buy high and sell low. It’s like being on an emotional rollercoaster, with highs and lows dictating actions. Emotional investing can lead to increased volatility, as investors react to market news and events without a clear strategy. Studies suggest that emotional decision-making can result in suboptimal returns, as investors fail to stick to their long-term plans. By developing a disciplined investment approach and focusing on long-term goals, investors can mitigate the impact of emotions on their financial decisions.

The Role of Cognitive Dissonance

Cognitive dissonance is the mental discomfort experienced when holding conflicting beliefs or attitudes. In investing, this can occur when investors experience losses but are unwilling to admit they made a mistake. It’s like trying to fit a square peg into a round hole. This discomfort can lead to rationalizing poor decisions, reinforcing incorrect beliefs, and avoiding necessary changes. Research indicates that cognitive dissonance can hinder learning and adaptability, as investors become resistant to new information. By being open to feedback and willing to reassess their strategies, investors can overcome cognitive dissonance and make more informed decisions.

Avoiding these psychological traps requires self-awareness and a willingness to challenge one’s assumptions. By understanding how cognitive biases influence investment decisions, investors can adopt more rational and effective strategies, ultimately improving their financial outcomes.