Understanding Financial Discipline

Financial discipline is much like learning to ride a bike. At first, it might seem overwhelming, but with practice, you can glide smoothly. Financial discipline is about managing your money wisely, ensuring you spend less than you earn. It’s not just about denying yourself pleasures but finding a balance. Think of it as training your financial muscles to gain strength over time. The goal is to create a sustainable way to save and spend that feels natural and satisfying. Embracing this mindset can transform your approach to money, making financial management a part of your everyday routine.

Setting Clear Financial Goals

Imagine setting off on a road trip without a destination. You’d likely end up lost. Similarly, financial goals provide direction for your money journey. Start by identifying what you want to achieve financially, be it buying a home, saving for retirement, or even a vacation. Break these goals into smaller, manageable steps. Having clear objectives helps you focus your efforts and motivates you to stick to your financial plan. Remember, these goals should be realistic, measurable, and time-bound. With clear goals, you’re more likely to stay committed and see progress over time.

Creating a Budget That Works

Budgeting is the blueprint of financial discipline. It’s like planning a meal; you need to know your ingredients and portions to get the recipe right. Begin by tracking your income and expenses to understand your spending patterns. Categorize your expenses into needs and wants, prioritizing essentials like housing and groceries. Set limits for each category and stick to them. A flexible budget allows for adjustments based on changing circumstances, ensuring you’re not living a life of deprivation. By creating a budget that reflects your lifestyle, you maintain control without feeling restricted.

Adopting the 50/30/20 Rule

The 50/30/20 rule is a simple budgeting technique that can ease financial discipline. Allocate 50% of your income to needs, 30% to wants, and 20% to savings. This method provides a balanced approach, ensuring you enjoy life while securing your financial future. Needs include essentials like rent and utilities, while wants cover dining and entertainment. The 20% savings can be split between an emergency fund and investments. This rule acts as a financial compass, guiding your spending decisions and helping you maintain a disciplined approach without feeling deprived.

Building an Emergency Fund

An emergency fund is your financial safety net, like a life jacket in stormy seas. Aim to save three to six months’ worth of living expenses. This fund provides peace of mind, protecting you from unexpected expenses like medical emergencies or car repairs. Start small, contributing a fixed amount each month until you reach your goal. Even $10 a week can grow over time, lessening the financial strain during emergencies. Having this cushion means you won’t have to rely on credit cards or loans, keeping your financial discipline intact.

Mindful Spending Practices

Mindful spending is about making conscious choices with your money. It’s like savoring each bite of a delicious meal rather than gobbling it down. Before making a purchase, ask yourself if it aligns with your financial goals. Avoid impulse buys by implementing a 24-hour rule, giving yourself time to reflect on the necessity of an item. Consider quality over quantity, investing in durable goods that offer long-term value. By practicing mindfulness, you’re more likely to spend intentionally, ensuring your money goes towards what truly matters.

Leveraging Technology for Financial Management

In today’s digital age, technology can be your ally in mastering financial discipline. Budgeting apps like Mint or YNAB (You Need A Budget) offer real-time insights into your spending habits. These tools categorize expenses, alert you of overspending, and provide a clear view of your financial health. Automation features, such as automatic savings transfers, ensure you’re consistently putting money aside without effort. Embracing technology simplifies financial management, making it easier to stick to your financial plan and achieve your goals.

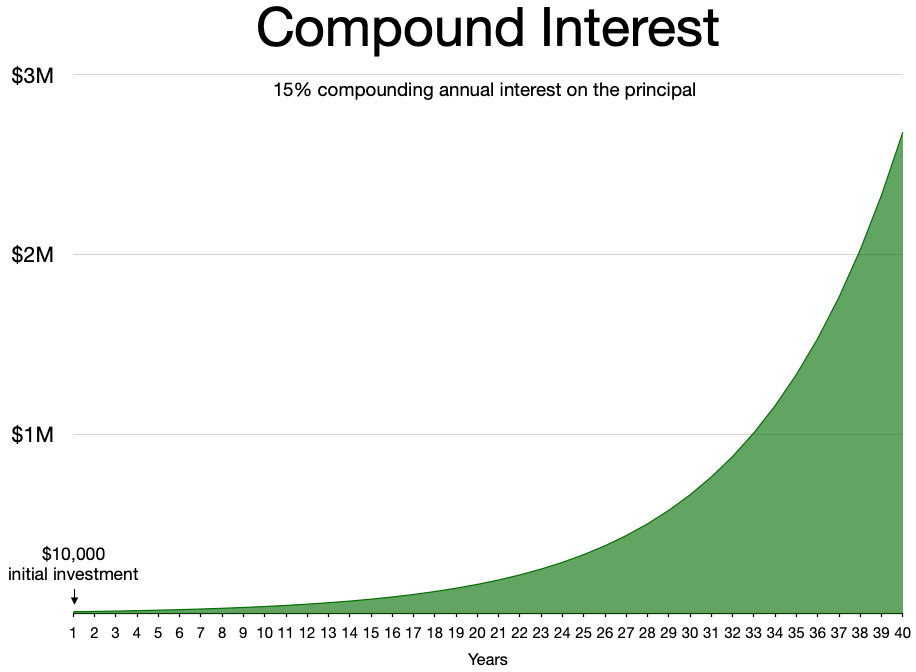

Understanding the Power of Compound Interest

Compound interest is like planting a seed and watching it grow into a tree over time. It’s the interest on your savings or investments that can significantly increase your wealth. Start saving early to take advantage of this powerful tool, as even small contributions can compound over years. Consider investing in retirement accounts or mutual funds to maximize returns. Understanding compound interest helps you appreciate the long-term benefits of saving, motivating you to maintain financial discipline for future rewards.

Learning to Say No

Saying no is a crucial part of financial discipline, akin to resisting a tempting dessert for your health’s sake. It means prioritizing your financial goals over immediate gratification. Whether it’s skipping a night out or avoiding unnecessary purchases, saying no helps you stay aligned with your budget. Communicate your financial boundaries to friends and family, ensuring they respect your choices. By learning to say no, you protect your financial well-being and empower yourself to make decisions that align with your goals.

Celebrating Financial Milestones

Celebrating milestones is essential in maintaining financial discipline, much like celebrating personal achievements keeps you motivated. Whether it’s paying off a debt or reaching a savings goal, acknowledging these successes reinforces positive behavior. Treat yourself to a small reward that doesn’t derail your budget, such as a nice dinner or a day trip. Celebrating progress reminds you of your achievements and encourages you to continue on your financial journey with enthusiasm and confidence.

These strategies can guide you toward mastering financial discipline without feeling burdened. Embrace the journey, and remember that financial discipline is not about restricting your life but enhancing it.