Understanding the Housing Market Cycle

The housing market is much like the seasons, with cycles of growth and decline. During a crash, property values can plummet, offering golden opportunities for those who know where to look. Historically, housing prices have been known to drop by as much as 30% during a recession. For example, the 2008 financial crisis saw a nationwide average drop of 31.8% in home prices, a statistic provided by the Federal Housing Finance Agency. Savvy investors have a keen eye for these patterns and prepare strategically to act when the market takes a downturn. Recognizing these cycles is akin to surfers waiting for the perfect wave; timing and readiness are everything.

Identifying Distressed Properties

In the turbulence of a housing market crash, many homeowners struggle financially, leading to foreclosures and short sales. This situation creates a window of opportunity for investors to purchase properties at prices below market value. RealtyTrac reported a 57% increase in foreclosures in 2020, providing a fertile ground for investors. By focusing on distressed properties, investors can purchase, renovate, and eventually sell them for a profit when the market recovers. It’s like finding a hidden gem in a thrift shop, knowing its true value with a little polish.

Leveraging Cash Offers

When the market declines, sellers often prefer cash offers as they ensure a quick and hassle-free transaction. Investors with liquid assets can capitalize on this preference, making competitive offers that stand out from those relying on financing. A cash offer can cut through the red tape and speed up the buying process, often leading to better deals as sellers are eager to close quickly to mitigate further losses. It’s akin to having cash at a yard sale; it speaks louder and closes deals faster.

Diversifying Investment Strategies

To navigate the choppy waters of a housing market crash, smart investors diversify their investment strategies. This might include investing in rental properties, flipping houses, or even exploring commercial real estate. The National Association of Realtors points out that rental demand often spikes during economic downturns, providing a steady income stream for investors. By spreading their investments across different avenues, investors can shield their portfolios from the storms of market volatility, much like a well-balanced diet supports overall health.

Timing the Market

Timing is everything in real estate, particularly during a crash. Those who can predict when the market will hit its lowest point stand to gain the most. Historical data suggests that the prime time to buy is usually within 12-18 months after a market crash. Investors who jumped into the market in 2009, shortly after the 2008 crash, witnessed significant appreciation in property values over the following decade. It’s like waiting for the right moment to plant seeds; the harvest will be bountiful if timed correctly.

Utilizing Real Estate Investment Trusts (REITs)

Investing in Real Estate Investment Trusts (REITs) is another avenue for profiting during a housing market crash. These companies manage income-producing real estate and offer a way to invest without directly buying property. During downturns, certain REITs may be undervalued, providing a chance for investors to buy in at a lower price. Nareit reports that the average annual return for REITs over the past 20 years has been around 9.5%, making them an attractive option. Investing in REITs is akin to owning a slice of a pie instead of the whole pie, enjoying the benefits without the hassle.

Understanding Market Indicators

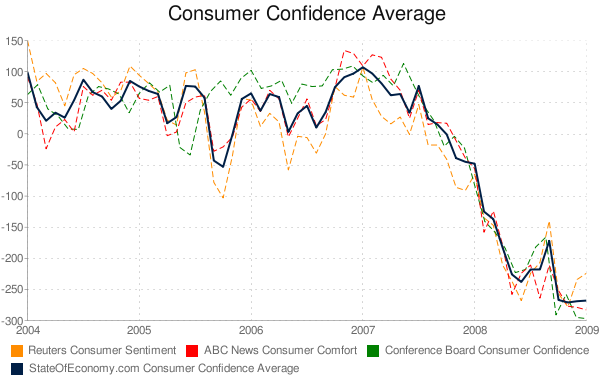

Astute investors closely monitor market indicators that hint at a housing market crash. Key signs include rising unemployment, declining consumer confidence, and increasing mortgage delinquencies. The Bureau of Labor Statistics noted that the unemployment rate peaked at 14.8% in April 2020, directly impacting the housing market. By keeping an eye on these indicators, investors can better position themselves to seize opportunities as they emerge. It’s like reading weather patterns before a storm; preparation is key.

Building a Strong Network

Networking is a crucial element for investors aiming to profit during a housing market crash. Cultivating relationships with real estate agents, lenders, and fellow investors offers valuable insights and access to off-market deals. A survey by the National Association of Realtors found that 88% of buyers purchased their homes through a real estate agent, underscoring the importance of a robust network. Like having a map in unfamiliar territory, a strong network guides investors through the complex landscape.

Focusing on Location

Even in the throes of a market crash, location remains a cornerstone of real estate investing. Investors should hone in on areas with solid fundamentals like job growth, population increase, and infrastructure development. The U.S. Census Bureau highlights cities such as Austin, Texas, and Boise, Idaho, as they have experienced notable population growth, making them attractive investment spots. Targeting these areas is like planting seeds in fertile soil, poised for growth when the market rebounds.

Staying Informed and Adapting

Lastly, smart investors remain vigilant about market trends and adapt their strategies accordingly. This involves keeping abreast of economic news, housing market reports, and changes in government policies that may impact real estate. For instance, the Federal Reserve’s interest rate decisions can significantly affect mortgage rates and housing demand. By staying informed, investors can make timely decisions that optimize their profits, much like a sailor adjusting sails to catch the wind.