A Surging Green Wave: Why the World Is Investing Differently

Imagine a world where cities are powered by sunlight, winds sweep across fields turning turbines, and rivers generate electricity silently. This is not a distant dream anymore—it’s quickly becoming reality. The unstoppable rise of green energy is not just changing how we power our lives; it’s transforming the very nature of international investment. The urgency created by climate change, combined with the promise of cleaner air and new jobs, has sparked a global race. Investors, governments, and corporations are all looking to green energy as the next big frontier, and their actions are sending shockwaves through traditional investment landscapes.

The Shift from Fossil Fuels to Renewable Power

For decades, fossil fuels like coal, oil, and gas dominated the world’s energy scene. Now, the tide is turning swiftly. Solar, wind, hydro, and geothermal sources are being embraced for their ability to generate energy without polluting the environment. This shift is more than environmental—it’s deeply economic. Investors are increasingly seeing fossil fuel assets as risky, while renewable projects offer not only safer returns but also growth potential. This dramatic pivot is fueling billions in capital flows into green energy, with far-reaching effects on global markets.

Government Incentives Lighting the Way

One of the most powerful forces behind green energy investment is government policy. Across the globe, nations are rolling out incentives that make renewable projects more attractive. Tax breaks, grants, and subsidies are common tools used to lower the cost of entry for investors. In the United States, federal tax credits have made solar and wind installations more affordable than ever before. The European Union, too, has set strict renewable targets and poured funding into green infrastructure. These policies not only encourage investment—they build confidence that green projects will thrive long-term.

Technological Breakthroughs Fueling Growth

Green energy is advancing at a breathtaking pace thanks to technology. Solar panels are now more efficient and affordable than ever, making rooftop solar a realistic option for millions. Wind turbines grow taller and more powerful, harnessing breezes even in low-wind areas. Battery technology, a crucial piece for storing energy, is improving rapidly and dropping in price. Each leap forward makes renewables more competitive with fossil fuels, attracting a fresh wave of investors who see new value and lower risk with each innovation.

Corporate Giants Join the Green Revolution

It’s not just governments and traditional energy companies getting in on the action. Some of the world’s largest corporations are investing heavily in green energy, reshaping their strategies for a sustainable future. Tech titans like Google and Apple have pledged to run entirely on renewables, investing in solar farms, wind parks, and battery storage. Their leadership is inspiring others to follow suit, creating a domino effect across industries. For these companies, it’s more than a PR move—it’s a calculated strategy to remain competitive, reduce costs, and prepare for potential regulations.

Asia: The Powerhouse of Renewable Investments

Asia, particularly China and India, is fast becoming the epicenter of green energy investment. China alone accounts for nearly half of all global spending on renewables, with massive projects spanning solar deserts and offshore wind farms. India is rapidly expanding its solar capacity, aiming to electrify rural regions and cut pollution in its cities. These investments are not just about energy—they’re about economic development, job creation, and securing a future as leaders in the global energy transition.

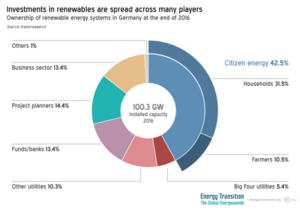

Europe’s Bold Moves Toward a Greener Grid

Europe has long been at the forefront of green energy, and its commitment remains unwavering. Countries like Germany and Denmark have pioneered wind energy, while Spain and Italy lead in solar power. The European Union’s ambitious climate goals are driving massive investments into new technologies and cross-border energy grids. These moves are helping the region reduce its reliance on fossil fuel imports, strengthen its economy, and showcase what’s possible when nations collaborate for a cleaner future.

Emerging Markets Seizing Green Opportunities

While wealthy nations make headlines, emerging markets are also embracing green energy with surprising speed. Countries in Africa, Latin America, and Southeast Asia are harnessing their abundant natural resources to leapfrog into renewables. For many, investing in green energy means providing electricity to remote communities, creating jobs, and reducing dependence on expensive energy imports. International investors see these regions as ripe for growth, offering high returns and a chance to make a meaningful impact.

Challenges and Roadblocks in the Green Race

Despite the momentum, green energy investment faces real hurdles. Some regions lack stable policies or face bureaucratic delays that slow project approvals. The initial cost of building renewable plants can be high, and not all investors are willing to take the risk. Intermittency—when the sun doesn’t shine or wind doesn’t blow—remains a technical challenge, though advances in storage are helping. Overcoming these obstacles requires coordinated efforts from policymakers, innovators, and investors who believe in the long-term promise of green energy.

The Ripple Effect on Global Financial Markets

As green energy gains ground, its influence on financial markets grows. Stock exchanges are seeing a rise in clean energy companies, while fossil fuel giants face increasing scrutiny from investors. Environmental, Social, and Governance (ESG) investing is now mainstream, with trillions of dollars flowing into funds that prioritize sustainability. This shift is not just about making money—it’s about aligning investments with values and preparing for a world where clean energy is the norm.

New Job Markets and Economic Opportunities

The boom in green energy is creating millions of new jobs worldwide, from manufacturing solar panels to installing wind turbines and managing smart grids. These jobs often pay well and offer training in cutting-edge technologies, revitalizing communities hit hard by the decline of coal and oil. For many countries, investing in green energy is not just about saving the planet; it’s about building a stronger, more resilient economy that works for everyone.

Investor Confidence in a Sustainable Future

With every new solar farm and wind project, confidence in the renewable sector grows. Investors are no longer asking if green energy is profitable—they’re debating just how big it can get. The sector’s resilience during global economic shocks has further cemented its reputation as a smart, future-proof investment. As more funds, banks, and pension plans shift their portfolios, green energy’s role as a financial powerhouse only becomes clearer.