Understanding Market Trends

Spotting the next big stock market winner requires a keen eye on market trends. These trends are like ocean currents guiding ships; if you know how to read them, you can navigate successfully. Start by observing patterns in the stock market, such as the rise of tech stocks in the early 2000s. Keep an eye on sectors that are gaining momentum due to technological advancements or changes in consumer behavior. For instance, the rapid rise of electric vehicles has been a major trend in recent years, leading to significant stock gains for companies like Tesla. By understanding these trends, you can position yourself ahead of the curve. Remember, market trends are not just numbers on a chart; they reflect real-world changes and innovations.

Analyzing Financial Statements

Financial statements are like the DNA of a company, revealing its health and potential. By carefully examining these documents, you can uncover valuable insights. Look at the balance sheet to assess a company’s assets and liabilities, giving you an idea of its financial stability. The income statement is your guide to understanding a company’s profitability, while the cash flow statement reveals how well it manages its finances. For example, a company with strong cash flow but low debt is often a safer bet. Don’t just focus on the numbers; consider the story they tell about the company’s performance and future prospects. This analysis can help you identify hidden gems in the stock market before they become household names.

Following Industry News

Keeping up with industry news is essential for spotting the next big stock market winner. News articles, press releases, and analyst reports can provide valuable information about a company’s potential. For example, if a tech company is launching a groundbreaking new product, it could lead to a surge in stock prices. Subscribe to industry-specific publications and follow influential figures on social media to stay informed. This constant flow of information will help you identify emerging trends and opportunities. Remember, the stock market is influenced by various factors, including geopolitical events and economic shifts, so staying informed is key.

Evaluating Management Teams

The people behind a company can be just as important as the products or services it offers. Evaluate the management team to understand their vision, experience, and track record. A strong leadership team can steer a company towards success, while a weak one can lead it astray. Look for executives with a history of innovation and growth. Consider their ability to adapt to changing market conditions and their commitment to corporate governance. A great management team can turn a struggling company into a market leader, making it a valuable investment opportunity.

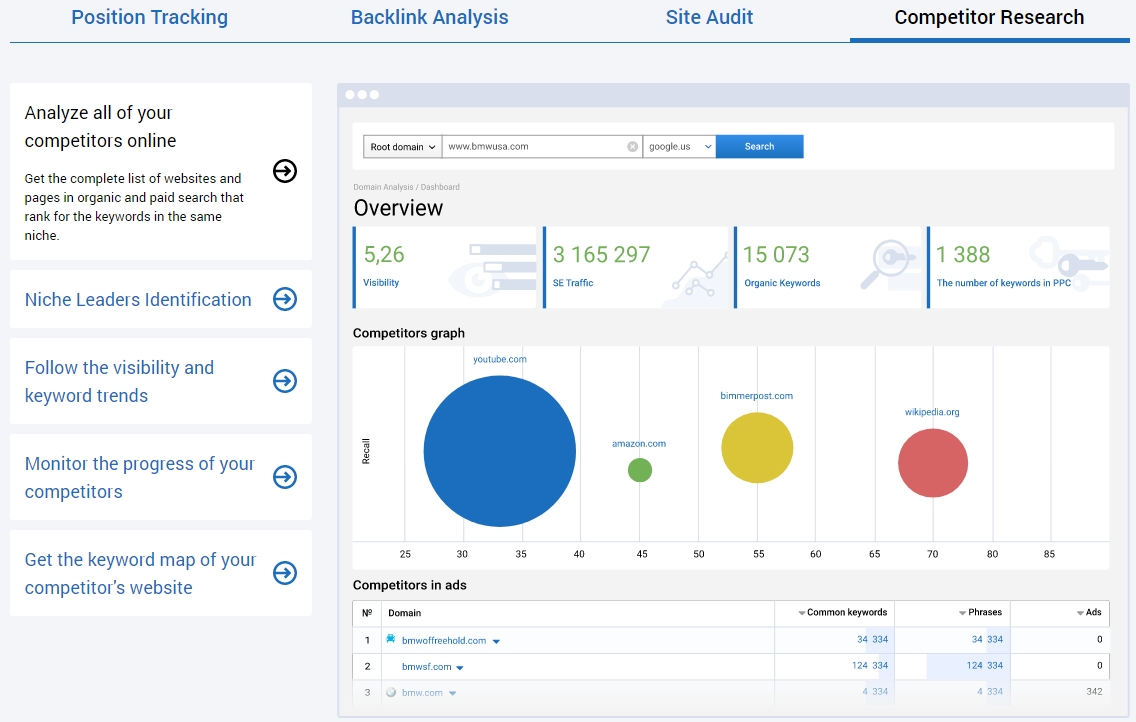

Studying Competitor Performance

Competitor analysis is another crucial step in identifying the next big stock market winner. By studying the performance of other companies in the same industry, you can gain insights into market dynamics. Compare financial metrics, such as revenue growth and profit margins, to gauge a company’s competitiveness. Understanding how a company stacks up against its rivals can reveal its strengths and weaknesses. For example, if a company consistently outperforms its competitors, it may have a competitive advantage that could lead to future success. This analysis can help you make informed investment decisions.

Monitoring Technological Advancements

Technological advancements can revolutionize industries and create new market leaders. Keep an eye on innovations that have the potential to disrupt traditional business models. For instance, advancements in artificial intelligence and blockchain technology have opened up new investment opportunities. Consider how these technologies could impact existing companies and create new ones. Companies that embrace and adapt to technological changes are often well-positioned for growth. By staying informed about technological advancements, you can identify stocks with the potential for significant gains.

Assessing Market Valuation

Market valuation is a critical factor in identifying the next big stock market winner. A company’s valuation reflects investor expectations and can indicate whether a stock is overvalued or undervalued. Look at metrics like the price-to-earnings ratio (P/E ratio) and the price-to-book ratio to assess valuation. A lower P/E ratio compared to industry peers may suggest that a stock is undervalued and has room for growth. However, it’s important to consider other factors, such as growth potential and market conditions. A thorough assessment of market valuation can help you identify investment opportunities that others may overlook.

Exploring Emerging Markets

Emerging markets can offer exciting opportunities for investors seeking the next big stock market winner. These markets are often characterized by rapid economic growth and evolving consumer preferences. Look for countries with expanding middle classes and increasing urbanization, as they tend to drive demand for goods and services. Companies operating in these markets can experience significant growth, making them attractive investment options. However, be mindful of the risks associated with emerging markets, such as political instability and currency fluctuations. A balanced approach can help you capitalize on opportunities while managing potential risks.

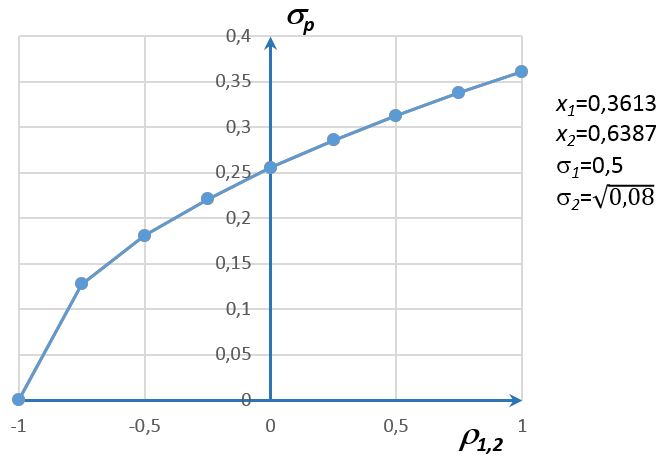

Utilizing Technical Analysis

Technical analysis involves studying historical stock price data and trading volumes to predict future price movements. This approach can help you identify potential stock market winners by recognizing patterns and trends. Tools like moving averages, trend lines, and relative strength index (RSI) can provide valuable insights. For example, a stock breaking through a resistance level may signal a potential upward trend. While technical analysis has its limitations, it can be a useful complement to fundamental analysis. By combining both approaches, you can make more informed investment decisions.

Building a Diversified Portfolio

Diversification is a key strategy for identifying the next big stock market winner. By spreading your investments across different sectors and asset classes, you can reduce risk and increase your chances of success. A diversified portfolio allows you to capitalize on opportunities while minimizing the impact of potential losses. Consider including a mix of growth stocks, dividend stocks, and defensive stocks to achieve a balanced portfolio. Remember, the goal is not to find a single stock that will make you rich overnight, but to build a portfolio that can deliver consistent returns over time.